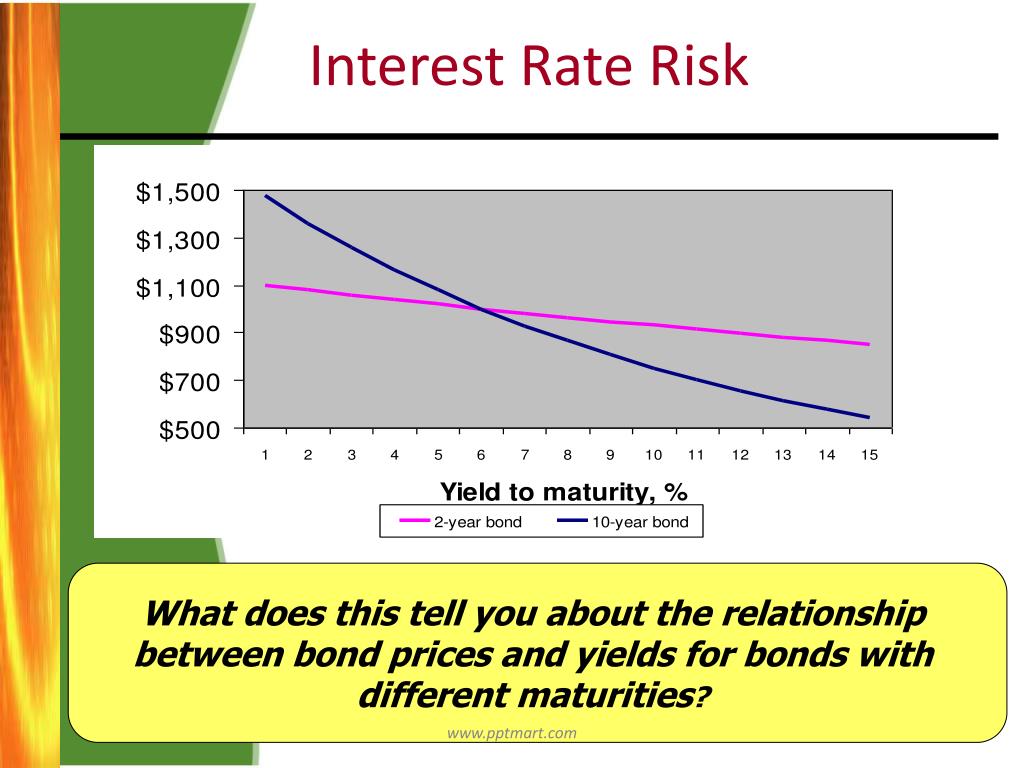

How Does Interest Rate Risk Affect Bonds . why are bonds sensitive to interest rates? bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. The impact of interest rates on bonds. Before we explain duration, let's back up and explain why changing interest rates affect a. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk.

from www.slideserve.com

Before we explain duration, let's back up and explain why changing interest rates affect a. why are bonds sensitive to interest rates? The impact of interest rates on bonds. interest rate movements and expectations of future movements affect bond market returns. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates.

PPT Valuing Bonds PowerPoint Presentation, free download ID4099890

How Does Interest Rate Risk Affect Bonds Before we explain duration, let's back up and explain why changing interest rates affect a. interest rate movements and expectations of future movements affect bond market returns. Before we explain duration, let's back up and explain why changing interest rates affect a. The impact of interest rates on bonds. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. why are bonds sensitive to interest rates?

From www.stopsaving.com

Bond Investing risk, interest rates, and bond prices How Does Interest Rate Risk Affect Bonds Before we explain duration, let's back up and explain why changing interest rates affect a. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. The impact of interest rates on bonds. why are. How Does Interest Rate Risk Affect Bonds.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments How Does Interest Rate Risk Affect Bonds Before we explain duration, let's back up and explain why changing interest rates affect a. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. The impact of interest rates on bonds. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices. How Does Interest Rate Risk Affect Bonds.

From www.honolulufinancialpartners.com

Managing Bond Risks When Interest Rates Rise Honolulu Financial Partners How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. Before we explain duration, let's back up and explain why changing interest rates affect a. The impact of interest rates on bonds. bond prices are inversely correlated with interest rates,. How Does Interest Rate Risk Affect Bonds.

From www.slideserve.com

PPT Valuation Concepts PowerPoint Presentation, free download ID How Does Interest Rate Risk Affect Bonds interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. The impact of interest rates on bonds. Before we explain duration, let's back up and explain why changing interest rates affect a. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices. How Does Interest Rate Risk Affect Bonds.

From www.slideserve.com

PPT Outline 5 Stock & Bond Valuation PowerPoint Presentation, free How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. why are bonds sensitive to interest rates? Before we explain duration, let's back up and explain why changing interest rates affect a. The impact of interest. How Does Interest Rate Risk Affect Bonds.

From analystprep.com

Bond’s Maturity, Coupon, and Yield Level CFA Level 1 AnalystPrep How Does Interest Rate Risk Affect Bonds The impact of interest rates on bonds. why are bonds sensitive to interest rates? interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. Before we explain duration, let's back up and explain why changing interest rates affect a. duration, yield to maturity, and different bond investment strategies. How Does Interest Rate Risk Affect Bonds.

From www.financestrategists.com

Interest Rate Risk Definition, Types, Measurement, Techniques How Does Interest Rate Risk Affect Bonds duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. why are bonds sensitive to interest rates? interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. bond prices. How Does Interest Rate Risk Affect Bonds.

From www.slideserve.com

PPT Bonds and Their Valuation PowerPoint Presentation, free download How Does Interest Rate Risk Affect Bonds Before we explain duration, let's back up and explain why changing interest rates affect a. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes. How Does Interest Rate Risk Affect Bonds.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. Before we explain duration, let's back up and explain why changing interest rates affect a. why are bonds sensitive to interest rates? duration, yield to. How Does Interest Rate Risk Affect Bonds.

From finance.gov.capital

How does Interest Rate Risk affect bond prices? Finance.Gov.Capital How Does Interest Rate Risk Affect Bonds The impact of interest rates on bonds. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. interest rate movements and expectations of future movements affect bond market returns. bond prices are. How Does Interest Rate Risk Affect Bonds.

From capital.com

What is interest rate risk Definition and Meaning How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. The impact of interest rates on bonds. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. why are bonds sensitive. How Does Interest Rate Risk Affect Bonds.

From studylib.net

Understanding Interest Rates and Risks in the Bond Markets How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. why are bonds sensitive to interest rates? The impact of interest rates on bonds. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. bond prices are inversely correlated with interest rates, meaning that when interest rates go up,. How Does Interest Rate Risk Affect Bonds.

From www.slideserve.com

PPT Interest Rates and Bond Valuation PowerPoint Presentation, free How Does Interest Rate Risk Affect Bonds Before we explain duration, let's back up and explain why changing interest rates affect a. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. why are bonds sensitive to interest rates? The impact of interest rates on bonds. duration, yield to maturity, and different bond investment strategies can. How Does Interest Rate Risk Affect Bonds.

From ballastadvisors.com

Managing Bond Risks When Interest Rates Rise Ballast Advisors How Does Interest Rate Risk Affect Bonds duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. The impact of interest rates on bonds. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. interest rate risk is the risk of changes in a bond's price due to changes in prevailing. How Does Interest Rate Risk Affect Bonds.

From www.investopedia.com

Interest Rate Risk Definition and Impact on Bond Prices How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. Before we explain duration, let's back up and explain why changing interest rates affect a. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. duration, yield to maturity, and different bond investment strategies can help. How Does Interest Rate Risk Affect Bonds.

From www.olympicinvestment.com

Managing Bond Risks When Interest Rates Rise Jim Clarke, Crystal How Does Interest Rate Risk Affect Bonds The impact of interest rates on bonds. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. why are bonds sensitive to interest rates? Before we explain duration, let's back up and explain why. How Does Interest Rate Risk Affect Bonds.

From www.slideserve.com

PPT Valuing Bonds PowerPoint Presentation, free download ID4099890 How Does Interest Rate Risk Affect Bonds interest rate movements and expectations of future movements affect bond market returns. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. bond prices are inversely correlated with interest rates, meaning that when interest rates go up, bond prices go. duration, yield to maturity, and different bond. How Does Interest Rate Risk Affect Bonds.

From us.etrade.com

Bonds, interest rates, and inflation Learn More E*TRADE How Does Interest Rate Risk Affect Bonds duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. Before we explain duration, let's back up and explain why changing interest rates affect a. The impact of interest rates on bonds. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. why. How Does Interest Rate Risk Affect Bonds.